- Do Influencers Pay Taxes?

- Top Ways Influencers Make Money

- Do Influencers Pay Taxes on Gifts?

- How do Influencers Report their Income?

- Taxes Influencers Are Responsible For

- Influencer Tax Write-Offs

- What Expenses Can I Deduct As An Influencer Or Content Creator?

- Common Tax Mistakes Influencers Make

- How Do YouTubers Pay Taxes?

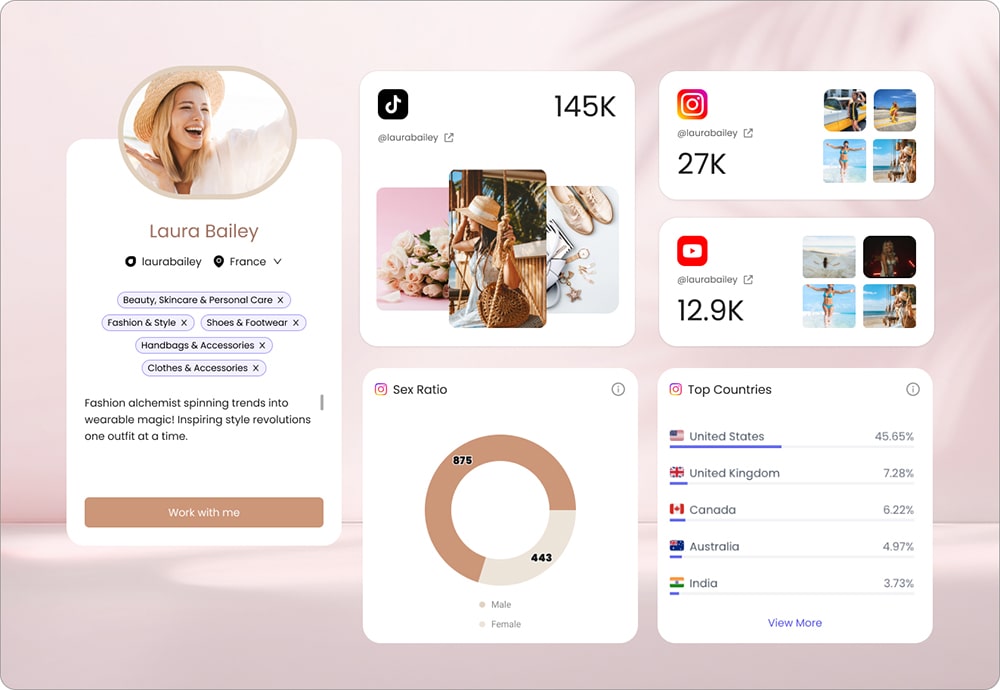

With the rise of the influencer economy, many new creators are jumping into the space. But there’s one question that always seems to come up: Do influencers pay taxes?

The simple answer is yes—if you earn money, you need to pay taxes. Being an influencer is fun, exciting, and wonderful. It’s also a job. And just like everyone else with a job, influencers pay taxes. But her similarities with a typical 9-5 end, as the rates, rules, and paperwork influencers must deal with significantly differ.

If you are an aspiring creator looking to be a full-time influencer or do it in your spare time, there are a few things about influencer taxes you need to know to ensure the legal and financial aspects of your work are covered.

Do Influencers Pay Taxes?

Whether you are a creator on Instagram, a TikToker, a blogger, or a YouTuber, if you make income from your online activities, you are considered self-employed. Depending on where you live, tax laws vary from country to country, and income earned from influencer activities (e.g. brand promotions affiliate marketing, advertisements) are considered a taxable income.

You don’t need to have millions of followers to be taxed as an influencer. Even smaller content creators—like nano and micro-influencers—fall under the same rules when it comes to influencer taxes and reporting income.

And as such, you need to report your earning to appropriate bodies and pay a federal income tax. Additionally, if you are considered an individual running their own business in your country, you may be subject to additional taxes, such as self-employment taxes or goods and services taxes (GST). Therefore, as a creator, it’s critical that you keep accurate track of your earnings and expenses connected to your influencer activities to accurately report them during the tax season.

Top Ways Influencers Make Money

Influencers can make money in several different ways, and all or some of these streams can be counted as taxable income. Here are some of the most common ways:

- Sponsored posts: This is when brands pay influencers to create posts, videos, or stories promoting their products or services.

- Brand ambassador roles for fixed or varying remuneration.

- Commissions for affiliate marketing: Influencers promote products and earn a commission when people buy through their affiliate link.

- Gifting campaigns: Free products influencers receive from brands in exchange for promoting them.

- Ad Revenue: Platforms like YouTube, Facebook, and Instagram offer ad revenue sharing. Influencers get paid based on how many people watch or interact with their content.

- Small Buisness: Some influencers create and sell their own products, like merch, online courses, or PDF guides.

Generally, if an influencer is expected to promote a brand product in one way or another in exchange for money or gifts, there is a chance that, depending on your location, it will be taxable.

Do Influencers Pay Taxes on Gifts?

Influencers often receive free products or gifts from brands as part of their collaborations, but it’s important to know that gifts are taxable too. If you get something in exchange for posting about it or promoting it, that’s considered income, and you’ll need to report it. For instance, if a brand sends you a $100 jacket and asks you to post about it, that’s taxable.

But don’t panic—there are a few things you can do to stay organized:

- Write down the value of any gifts you receive, especially if they’re tied to a promotion.

- Report gifts tied to promotions: If a brand sends you a gift in exchange for a post, it counts as taxable income and should be reported.

- If the gift is small and not tied to any agreement, you might not need to report it, but keep records just in case.

- Gifts that help build your brand or support your content creation are considered part of your income, so stay organized with your records.

If you’re unsure whether a gift is taxable, it’s always a good idea to ask a tax expert.

How do Influencers Report their Income?

Just like with any other type of work, if you’re an influencer, you must report all the money you earn. This is where tracking your income comes into play.

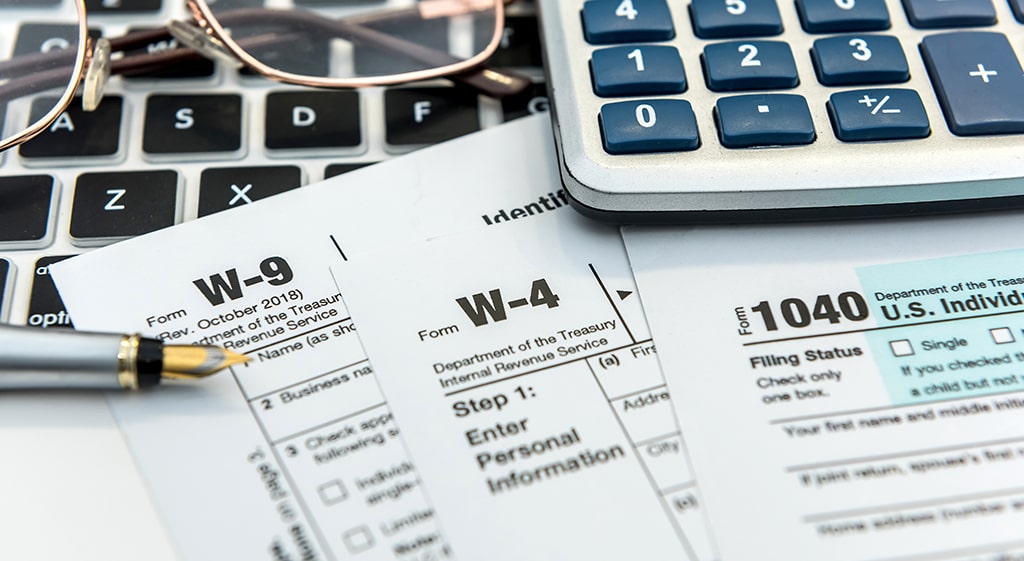

For those in the U.S., influencers typically receive Form 1099 from companies they’ve worked with if they earned over a certain amount (usually $600). This form shows how much money the company paid you. If you get 1099 forms, they need to be included when filing taxes.

Even if you don’t receive a 1099, you are still responsible for reporting the income. This is especially important for affiliate marketing taxes, where you may not get a formal tax document but still have earnings that need to be reported.

To keep everything in order, it’s a good idea to track all of your income using a simple system. You can use spreadsheets or accounting software to log your earnings from all sources. Many influencers use apps like QuickBooks or FreshBooks to track payments and expenses.

Taxes Influencers Are Responsible For

Now let’s get into the different taxes influencers are responsible for. There are a few key types to keep in mind:

Income Tax

Just like anyone else who earns money, influencers have to pay income tax on what they earn. The rate you pay depends on how much you make and where you live, but if you’re earning money as an influencer, you’ll need to report it as personal income.

Self-Employment Tax

Most influencers are considered self-employed because they’re working for themselves. This means that in addition to income tax, you’re also responsible for paying self-employment tax. This tax covers Social Security and Medicare, which would normally be taken out of your paycheck by an employer.

The self-employment tax rate is 15.3%, which is applied to your net income. That’s why it’s crucial to track all your income and expenses, so you can minimize your taxable income.

Sales Tax

If you sell products—like t-shirts, books, or other merchandise—you may also need to collect sales tax. The rules on this vary by state (or country), so check with a tax professional to see if you need to add sales tax to your products.

International Tax Considerations

If you’re an international influencer or if you work with global brands, you might need to consider international tax rules. Some countries have treaties that impact how much tax you’ll pay, and you might be subject to different rules based on where you live and where your audience is located.

Influencer Tax Write-Offs

They say there are two things that are certain in life, and taxes are one of them. Luckily, there is a way to minimize the taxes you pay for your hard-earned income, and it’s the tax write-offs. Tax write-offs, also known as deductibles, are specific expenses or an amount that you can subtract from your total taxable income, lowering the amount of taxes you owe to the state.

Tax write-offs aim to help individuals and businesses to account for the expenses that arise when earning the income for which you are taxed. These expenses are considered necessary when running the business (or, in your case, cooperating with brands as an influencer).

For example, a teacher could receive a tax write-off on their purchase to be used in class from their own pockets. Similar to taxes in general, tax write-offs are subject to specific rules and limitations, depending on your country, and not all of your expenses will be eligible for deduction.

What Expenses Can I Deduct As An Influencer Or Content Creator?

Now, tax write-offs are common in many areas of business, and despite many creators being unaware, they are also perfectly legal in influencer marketing. Below, we take a look at what tax write-offs are available to you as an influencer and how you can take advantage of them to save money. And the good news is, there are many ways to do just that.

Travel Expenses

In many businesses, travel expenses are written off, and content creation is no exception. This one is particularly useful for travel influencers, who are trotting around the globe to craft and share their content. Tax write-offs here can include transportation, accommodation, meals, entertainment, and more. Please note that to be eligible for travel expense tax write-offs, the experiences will typically be required to have taken place outside of the tax jurisdiction (you will not be eligible for travel tax write-offs for a trip in the US if you are from the US).

Marketing & Promotion

In the influencer world as in everywhere in business, marketing is important. And as such, any amount you spent on promotion, including ads you run on Instagram and Facebook, can be deducted from your total taxable income.

Home Office

Many influencers work from home, and one of the many reasons for this is that in certain countries, home office tax deduction is allowed. If you are working from the home office, you can write off percentages from your rent tax, insurance, mortgage interest, and other eligible payment, but only for the area you use as your office.

Equipment

Equipment you use for work is another essential part of your process of earning income, and as such, is eligible for tax deductions. Cameras, laptops, editing software, and microphones are among the tax write-offs for creators.

Professional fees

Despite being self-employed, you don’t operate your business alone, and may often refer to professionals for help, including tax or legal advice, shooting and editing teams, and more. These expenses are among the ones you as an influencer are allowed to be written off. Not all of these tax write-offs will be available to you at all times, but they can help you save significant amounts of money on taxes, depending on the type of work you do.

Common Tax Mistakes Influencers Make

Tax mistakes can be costly, so here are some common errors to watch out for:

- Not Reporting All Income: Even if you don’t get a 1099, you must report all your income. Failing to do so could result in penalties.

- Not Keeping Good Records: Keeping track of expenses and receipts is essential. If you can’t prove you spent the money, you can’t deduct it.

- Mixing Business and Personal Expenses: Be careful not to use your business income for personal purchases. If you do, it could complicate your taxes.

- Not Setting Aside Money for Taxes: As a self-employed influencer, you’ll likely need to pay quarterly taxes. Not setting aside money could lead to a big tax bill at the end of the year.

Not paying taxes as an influencer can lead to some serious problems. If you don’t file or pay your taxes, you could face penalties and fines from tax authorities like the IRS. Plus, failing to report all your income or claiming the wrong expenses could trigger an audit, which is stressful and time-consuming.

On top of that, if people find out you’re not paying your taxes, it could hurt your reputation. Brands may be less likely to work with you, and your audience might lose trust. It’s better to avoid these issues!

How Do YouTubers Pay Taxes?

When thinking of influencers, first content creators on social platforms like Instagram and TikTok come to mind. But there is another group of influencers that make a comfortable living through longer-form content via YouTube. And as with other influencers, YouTubers are subject to taxation as well. If you already have your YouTube channel or think of launching one, there are several ways you will earn income through YouTube. These are:

- Watch Page and Shorts Feed ads – earnings from ads displayed on their video content.

- Shopping – Revenue from the influencer’s YouTube Shopping store or affiliate marketing for tagged products.

- YouTube Premium revenue – share of subscription fees from YouTube Premium subscribers who watch their content.

- Channel memberships – Payments from members who get access to exclusive content and other perks.

- Super Chat & Super Stickers – Payments fans make to have their messages or animated images highlighted in live-stream chats

- Super Thanks – Payments fans make to view animations and have their messages highlighted in the video or Short’s comments section.

All this income is taxed, and the platform is significantly involved in the process. YouTube is required by law to collect the tax information of its creators, those living both in the US and abroad, and if they don’t receive that information, they can withhold as much as 24% of their earnings.

Creators outside the US need to fill out the digital W-8BEN form to share their tax information with the platform. Despite this, YouTube won’t do your taxes for you: similar to other social media platforms, you need to collect your income and expense information carefully, deduct what can be written off (including the expenses listed above), and pay the remainder during the taxation season.

To Sum Up

So, do influencers pay taxes? Absolutely. If you’re an influencer earning money from any form of content creation, you need to report that income and pay taxes. The good news is, there are ways to manage and reduce your tax burden with proper deductions and organization.

Being proactive about how to file taxes as a content creator will help you avoid fines, maximize your deductions, and keep your business running smoothly. Whether you’re just starting out or you’re a seasoned influencer, staying on top of your taxes is essential for long-term success.

Make sure you keep good records, track all your income and expenses, and, when in doubt, consult with a tax professional to help you navigate the complexities of influencer taxes.

Frequently Asked Questions

As an independent contractor, you will receive various forms from the companies you partner with, for each cooperation. Please note that these documents will vary per country. In the US, you will receive Form 1099-NEC from each partner who pays you $600 or more. For payments less than $600 Form 1040-NEC is to be filled. Creators earning on YouTube and operating outside of the US will receive Form W-8BEN to share their tax information. To file taxes on gifts, if those gifts are not monetary, you need to assign them a monetary value. Then, complete Form 709, the Gift Tax form to legally accept the gift and ensure that all legal obligations are covered.

When it comes to the timeline of paying taxes as an influencer, there is no single right answer: the taxation season varies from country to country, and the time to pay the taxes for creators typically coincides with this season. In some countries, like the US, the taxation process takes place once a year, while in other countries taxes are paid every three months.

Influencers are considered to be independent contractors/self-employed, and as such, are subject to the self-employment tax. Most companies, when working with an influencer, set up each creator as a contractor in their accounting. However, this can vary in different countries and per company. Other common tax categories for influencers are “Small Business Owner” and “Other Earned Income.”

Many brands give influencers gifts in exchange for promotions or mentions. Typically, when an influencer receives payment for their promotional services, whether it’s in the form of money or a gift (cosmetics, clothing, technology pieces, and whatnot), it will be taxable. However, there can be exceptions, and the situations should often be examined on a case-by-case basis.

Reviewed By Rem Darbinyan

Revolutionizing industries with AI, Rem Darbinyan is the CEO of ViralMango and an entrepreneur, AI expert, and influencer marketing strategist.